Dear friends,

Welcome to the October issue of the Mutual Fund Observer. We’re glad you’re here.

And welcome to the Dog Days of Autumn! The natural world is scrambling to keep up with the changes we’ve triggered, and continue to intensify, upon it. As I walked one of the many bike/hike trails in the Quad Cities on Sunday, I confronted two worlds. One was defined by 90-degree temperatures, hot sunshine, and cracked earth. The other by the rhythm of birds called southward and plants quietening for the season to come, ready for the renewal that heralds the spring.

Some plants need the signal of darkness to trigger their autumnal bloom. The mums in our south garden once attended my mum’s funeral; today, they celebrate, triggered by the lengthening night. A sort of “geez, it’s getting dark around here, I better get my butt moving” response.

I wonder if we might take inspiration from them?

In this month’s Observer …

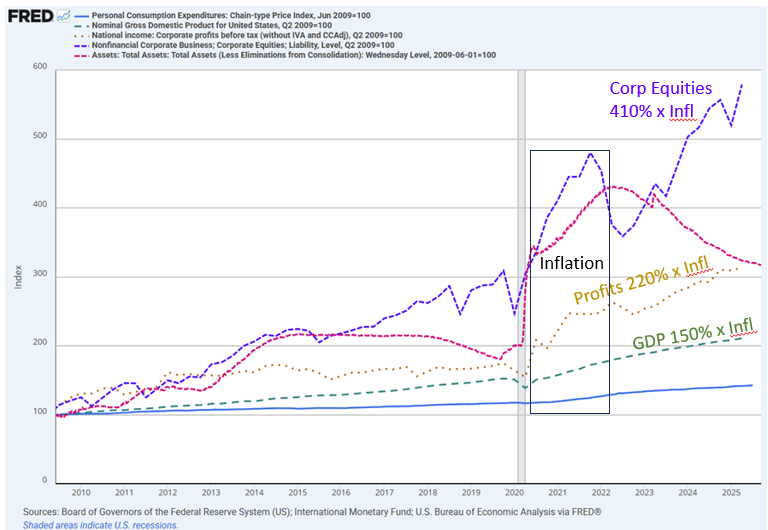

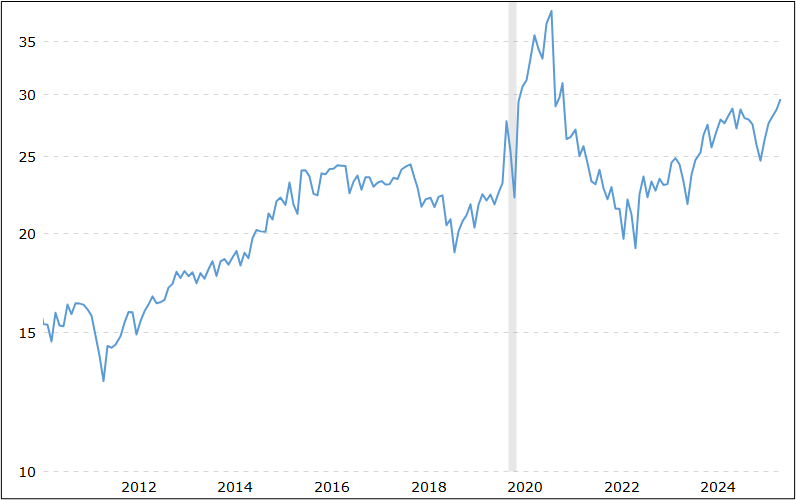

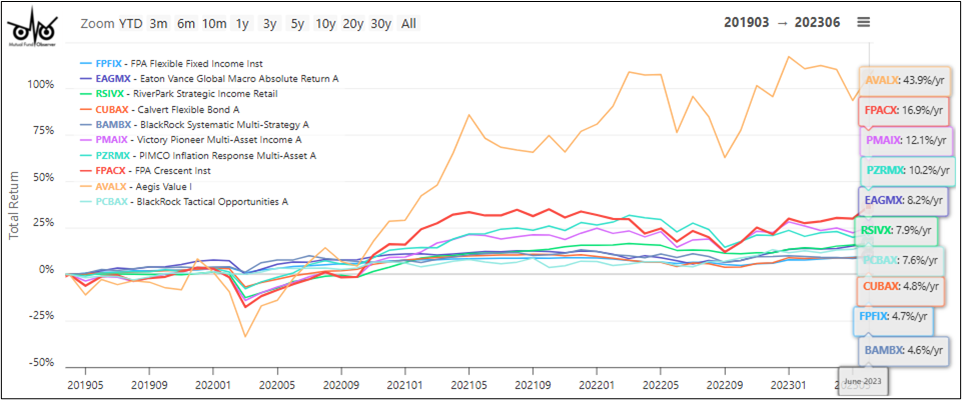

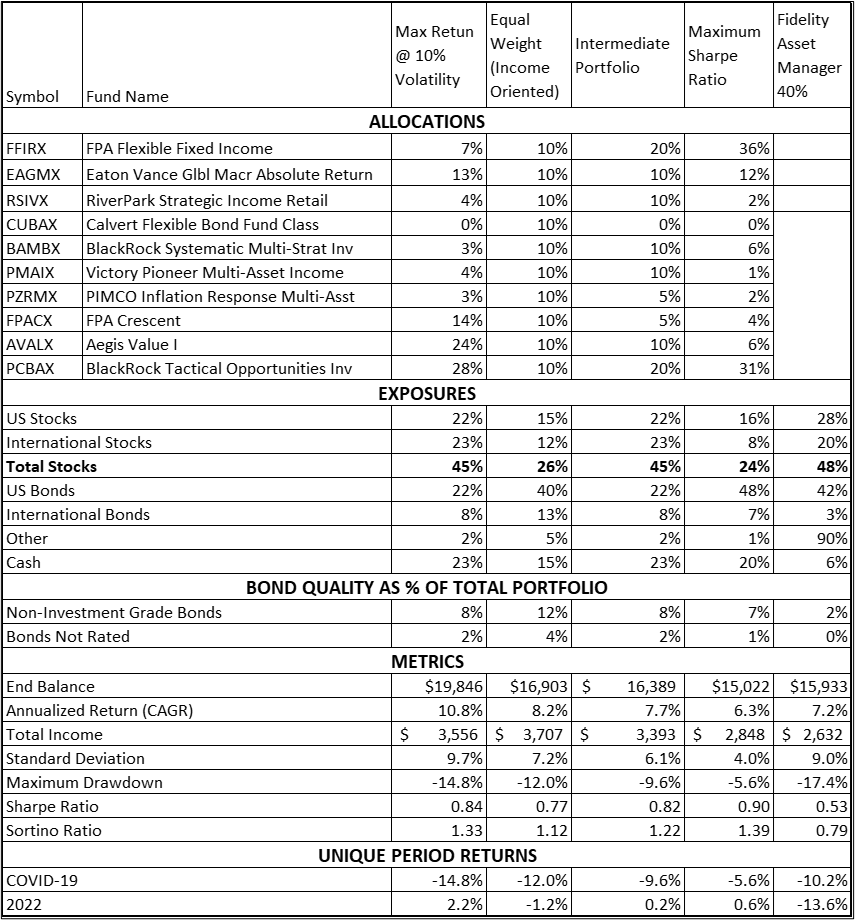

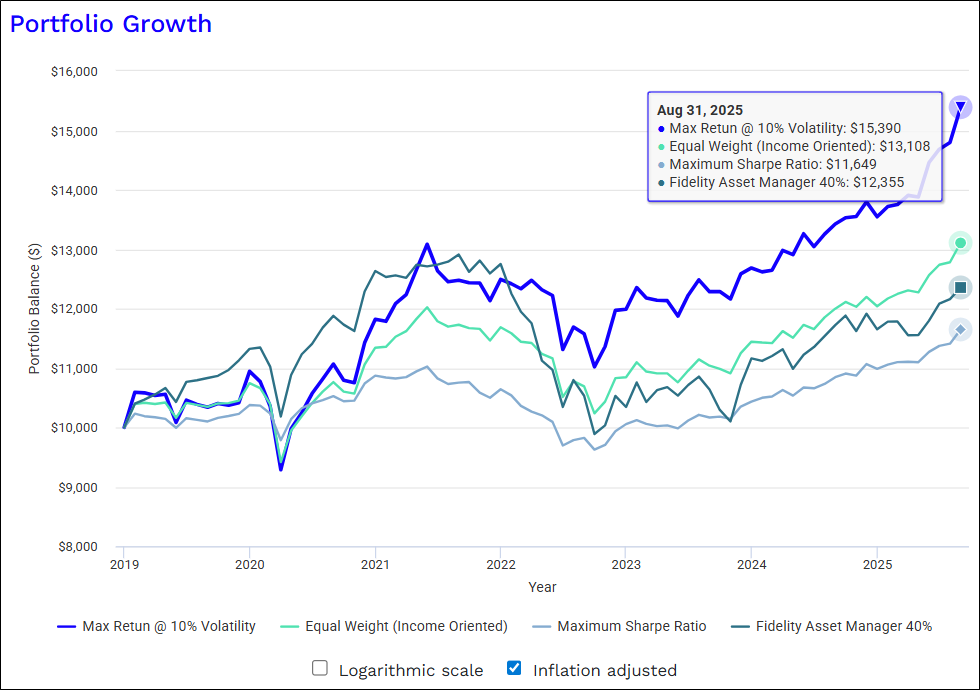

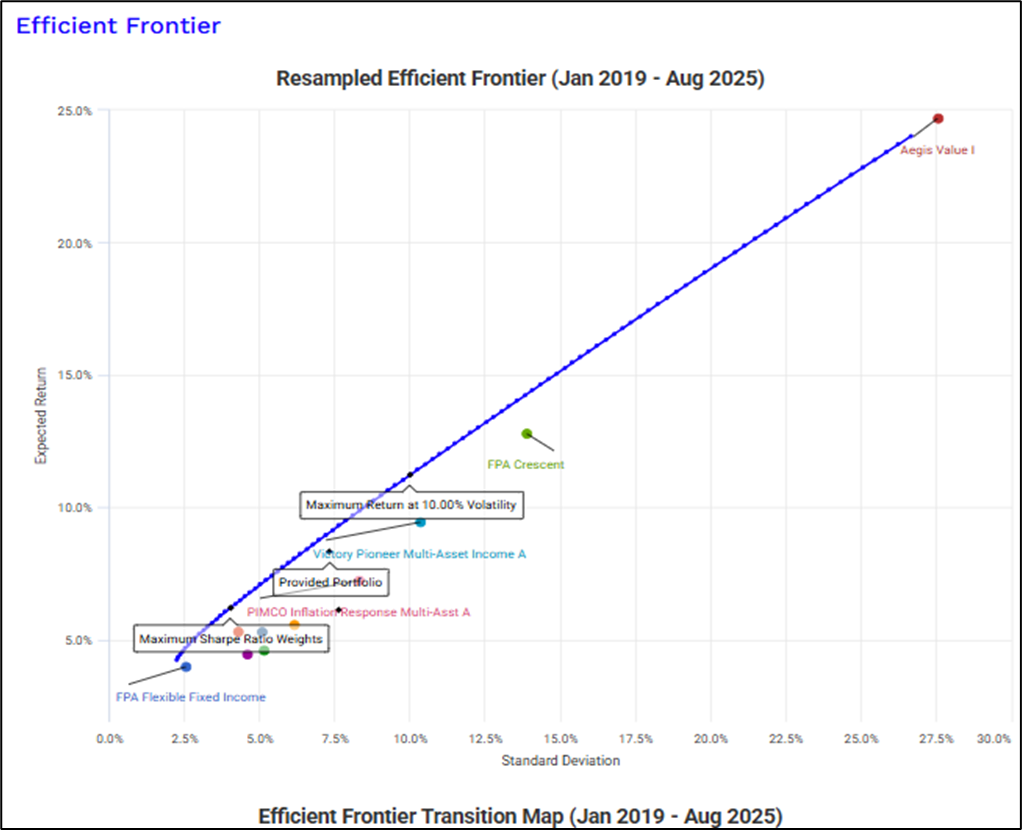

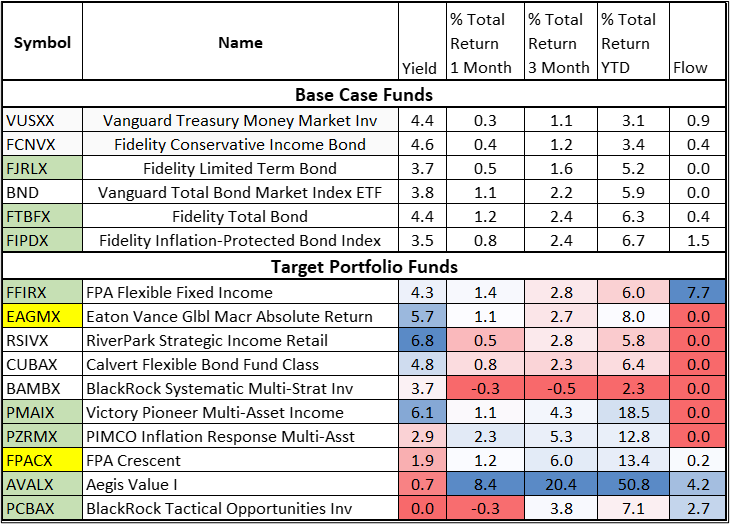

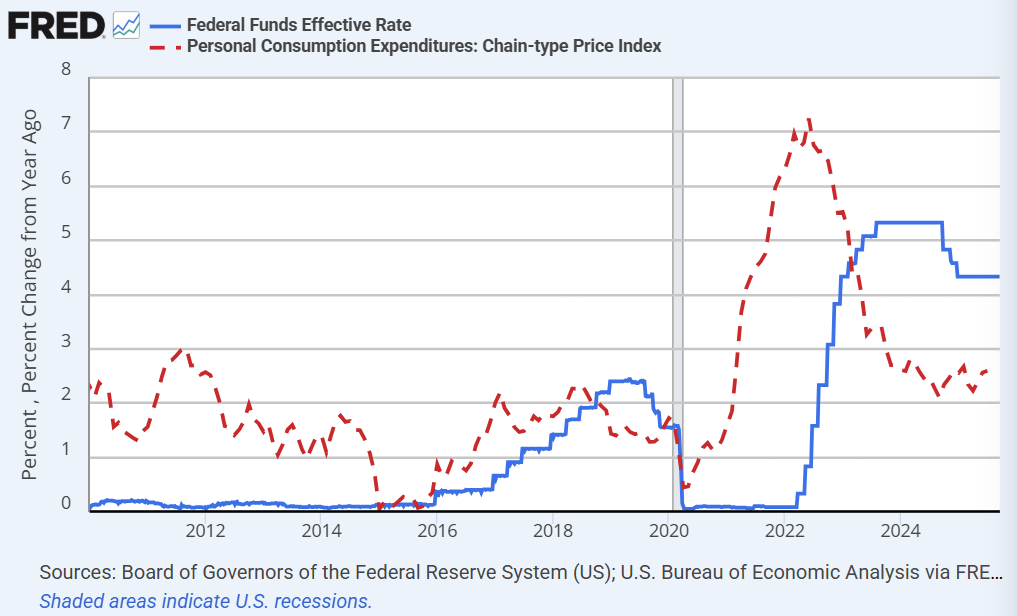

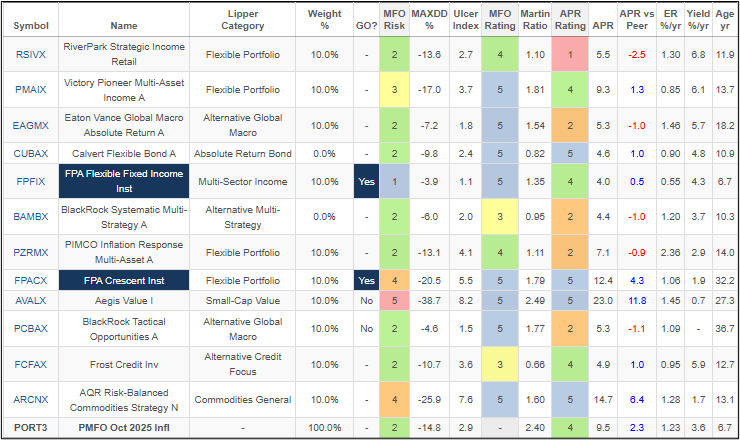

Our colleague Lynn Bolin addresses portfolio construction for uncertain times with two complementary October pieces. In “Putting My Conservative Retirement Portfolio on Cruise Control,” he presents a ten-fund “all-weather” strategy targeting 8% returns with 12% maximum drawdown, emphasizing Alternative Global Macro, Alternative Multi-Strategy, and globally diversified funds. Drawing on Rob Dix’s The Price of Money and Kenneth Rogoff’s Our Dollar, Your Problem, Bolin argues that Quantitative Easing inflated asset prices, while current high valuations suggest below-average future U.S. stock returns, leading him toward funds like FPA Flexible Fixed Income (FPFIX), PIMCO Inflation Response Multi-Asset (PZRMX), and BlackRock Tactical Opportunities (PCBAX).

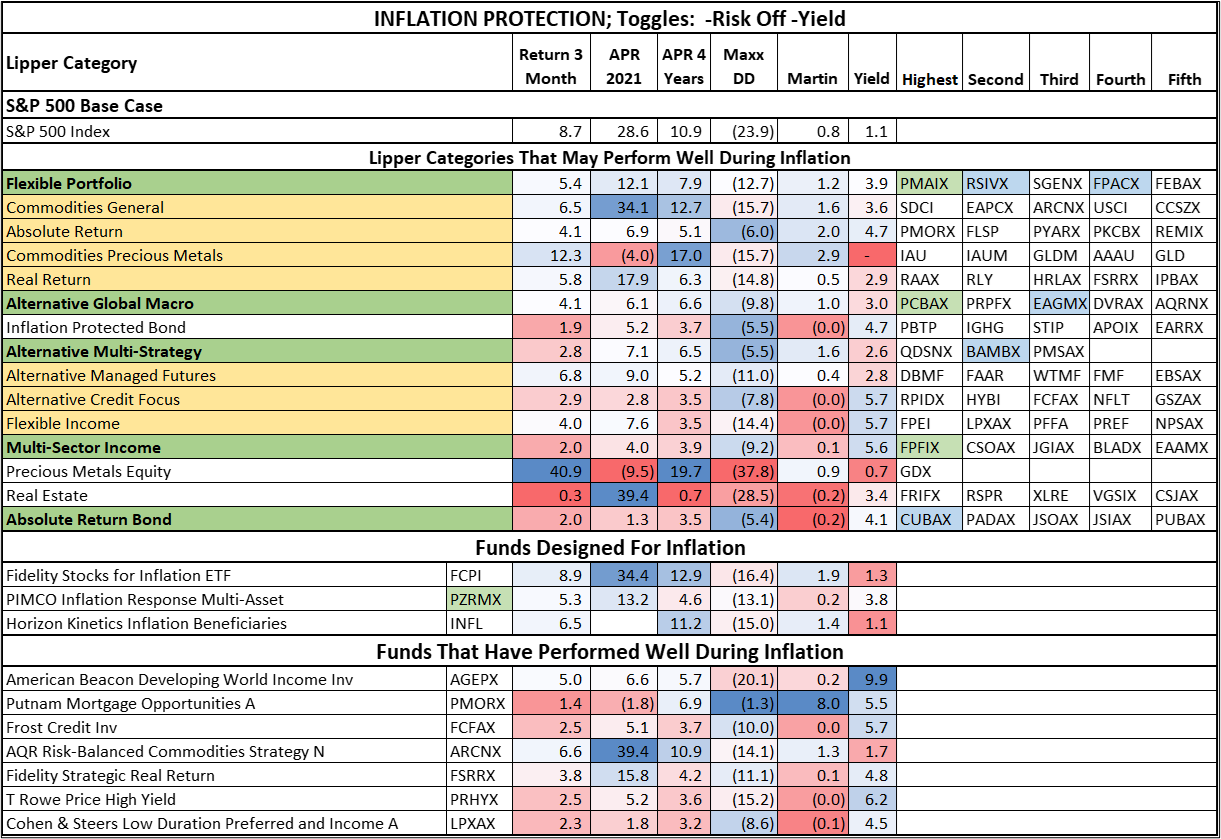

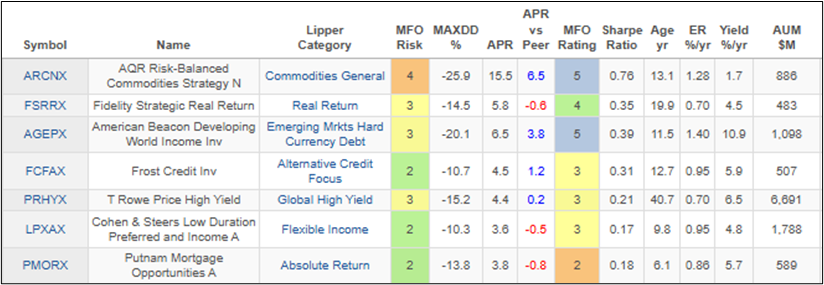

His companion article, “Long-term Inflation Protection for Conservative Portfolios,” explores hedges against what Dix and Rogoff predict will be “more frequent bouts of inflation” and financial instability. While gold has soared past $3,750, Bolin seeks lower-volatility alternatives, comparing funds like AQR Risk-Balanced Commodities Strategy (ARCNX) and Frost Credit (FCFAX) against his target portfolio. Though Lynn is not expecting 1970s-style stagflation imminently, he’s adding fifty funds to his evaluation system for potential portfolio modifications, balancing inflation protection with his conservative risk tolerance. Stay tuned!

We had an unusual wealth of fund launches to report on, resulting in two Launch Alerts and one not-quite-Launch-Alert.

Tweedy, Browne International Insider + Value ETF launched on September 10, 2025. It is active, quantitative, and research-driven. It works from two assumptions, which are corroborated by a lot of evidence. You should:

- Identify undervalued stocks because value works

- Identify undervalued stocks where the corporate insiders confirm your assessment by either buying large amounts of the stock themselves or initiating stock buybacks.

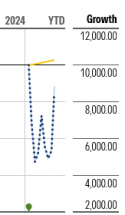

If the folks in the know are pouring money into stocks you’ve identified as undervalued, that’s a powerful confirmation. It has worked well with its sibling, Tweedy, Browne Insider + Value ETF, which launched in 2024, falls in the mid-cap value box, and is up 23% YTD.

RACWI US ETF launched on September 11, 2025, and is Research Affiliates’ permutation of an S&P 500 index fund. Here’s the tweak: RAFI starts with the question, “Should these firms even belong in the investable universe?” They answer that question by looking at corporate fundamentals (do they make money?) and then excluding companies that are failing, without regard to their stock price. Currently, they exclude about 25 of the S&P 500 companies, but then market-cap-weight the remainder just as the S&P does.

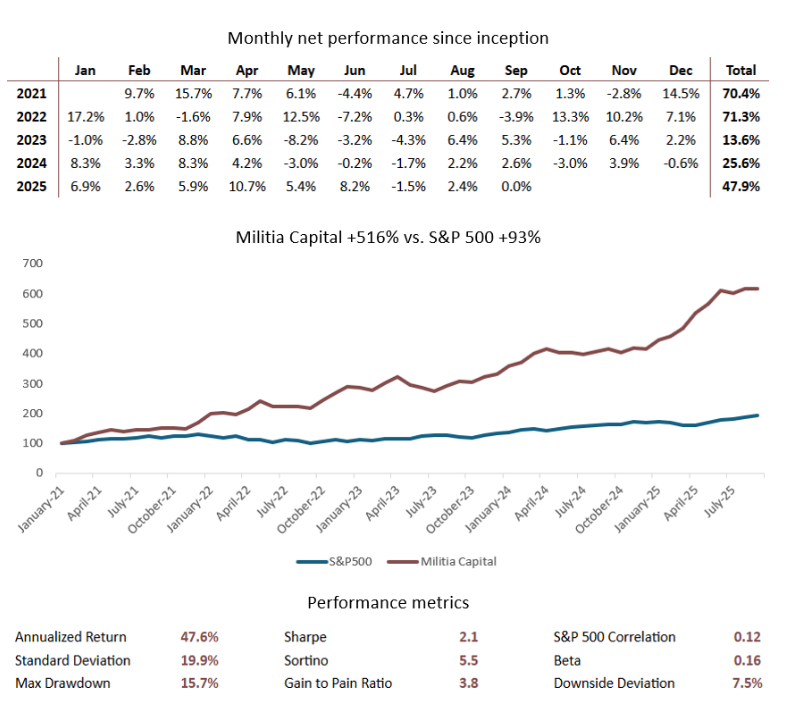

The Militia Long/Short ETF is the not-quite-a-Launch-Alert. Launch Alerts target funds launched in roughly the past 6-8 weeks, while Militia launched in January 2025. We wanted to put it on your radar because Sam Lee, former Morningstar editor and strategist, founder of SVRN Asset Management, former MFO contributor, and a remarkably smart guy, wanted to put it on ours.

The Militia Long/Short ETF is the not-quite-a-Launch-Alert. Launch Alerts target funds launched in roughly the past 6-8 weeks, while Militia launched in January 2025. We wanted to put it on your radar because Sam Lee, former Morningstar editor and strategist, founder of SVRN Asset Management, former MFO contributor, and a remarkably smart guy, wanted to put it on ours.

Finally, The Shadow reports on the industry’s latest tribulations, including T. Rowe Price’s decision to liquidate its once-promising T. Rowe Price Multi-Strategy Total Return Fund, a bunch of funds deciding they’d rather go to the ETF dance, and Dodge & Cox triggering three sets of share splits.

The conversion story took a twist in early October with the SEC’s imminent announcement of a decision to permit ETF share classes of mutual funds. That means that you might be able to choose either the Fidelity Low Priced Stock fund’s no-load retail share class or the same fund’s ETF share class. According to Morningstar, at least 75 fund firms have lined up to create ETF shares of their existing funds, which might well blunt the incentive for the fund-to-ETF conversions that have proliferated in the past year or two.

Like lambs to the slaughter

Geoff Colvin, senior editor-at-large at Fortune, made two useful observations in late September:

His simple statement that stocks are highly valued is indisputable. Most measures are screaming that the S&P is insanely overpriced. The Shiller Cyclically Adjusted Price/Earnings ratio is the highest it has been since the dotcom peak. The price-to-sales ratio hit a new all-time high this week. The Buffett Indicator—ratio of the market’s capitalization to GDP—says stocks are highly overvalued, and Warren Buffett is holding an enormous cash cache because he can’t find bargains.

But also:

Greenspan gave his [Irrational Exuberance] speech in December 1996—almost four years before the market plunge. As he told Fortune years later, “If you had left the market when I gave my irrational exuberance speech, you would have missed another 80% of increase” in stock values. (Actually, it was closer to 100%.) (“Back in the ’90s a Fed chief warned about ‘irrational exuberance’ in the markets. Stocks rose 105% over the next 4 years,” Fortune, 9/30/2025)

CNN notes the same anomaly: “Hiring is at a standstill. Inflation is on the rise again. Consumer sentiment is slipping near historic lows. Americans are increasingly fed up with the economy” (“Why are stocks setting records when the economy feels down in the dumps?” CNN, 9/15/2025).

Satya Pradhuman, once the chief small cap strategist at Merrill Lynch and now director of research at Cirrus Research, claims that the market is already in crazy-land: “The melt-up of risk-taking in U.S. equities has pierced the upper boundaries of a normalized range. A combination of a very crowded equity market, combined with an extreme risk appetite, places the U.S. equity market into an overtly speculative chapter” (“Stock market’s relentless rally threatens to turn into a ‘melt-up’,” via Dow Jones, 9/13/2025).

Quartz reports, “Wall Street’s penny aisle is back in business. More than 90 companies — including a Hong Kong noodle shop and a smattering of obscure startups — have floated IPOs this year at $5 a share, the highest number since the Regan years. Penny stocks’ comeback has less to do with solid fundamentals than it does with commission-free apps that turn speculation into a swipe, crypto-fueled investors chasing the next moonshot, and a regulatory spotlight that has wandered elsewhere. For retail traders shut out of $4 trillion tech titans and six-figure Bitcoin, penny stocks offer a cheap thrill: thousands of shares for less than the price of a single iPhone” (Quartz Daily Brief, 9/25/2025).

On the day I write this (a) the federal government shut down, (b) the jobs report from ADP was disastrous, and (c) the stock market went up.

The federal response has been “to boldly implement” Trump’s order to get alternative assets into retirement plans (Department of Labor News Release, 9/23/2025), while FINRA moved to relax the rules surrounding day-trading, so both retirement and non-retirement investors can treat their portfolios like a roulette wheel! Whee?

The federal response has been “to boldly implement” Trump’s order to get alternative assets into retirement plans (Department of Labor News Release, 9/23/2025), while FINRA moved to relax the rules surrounding day-trading, so both retirement and non-retirement investors can treat their portfolios like a roulette wheel! Whee?

The key to all of this is the willingness of the American consumer (aka “you”) to continue having confidence in Mr. Trump’s steady hand on the tiller, which leads you to continue buying more and more stuff, relying on more and more debt (currently a record $18.4 trillion) to do so. And the level of stock ownership is now at a record high; almost 45% of Americans’ net wealth rests in their stock portfolios (Federal Reserve data, 9/28/2025). So the American consumer is propping up the stock market, and the stock market is propping up the economy, and now consumer confidence is cratering.

Will there be a devastating market crash? Yep.

Soon? Maybe. Maybe not.

What’s an investor to do? The same as always, dear friends. Act before the storm, not during it. Find an asset allocation (mine, as readers now, is 25/25/25/25) that will likely produce the returns you need to meet your goals with a level of volatility that allows you to continue enjoying life and sleeping regularly. Our recommendation has always been to look for managers who earn their keep and your trust: they have an enormous dislike of losing your money, they’re fully invested with you, they speak sensibly, and have a record of success across friendly and hostile markets. Do not ever sit at the same table with someone who preens and struts and talks about beating the market; they’re fools and potentially contagious. The goal is not to “beat the market,” it’s to live a good life and then move on.

Farewell, Jonathan Clements (1963-2025)

Jonathan Clements, who died this week of cancer at 62, was that rarest of financial journalists: someone the industry couldn’t buy, couldn’t charm, and couldn’t seduce into softening his message. For nearly two decades at The Wall Street Journal and later as founder of Humble Dollar, he wielded his pen like a scalpel, cutting away the jargon, the self-serving studies, and the expensive nonsense that Wall Street had convinced investors was gospel.

Jonathan Clements and I corresponded once, around the launch of Humble Dollar. He was amiably cool from my perspective, which I expected and respected. I invited him to add his voice to Mutual Fund Observer when it called to him, but he had other plans and, as it turned out, far greater success.

Clements’s prescription was elegant in its simplicity: eliminate human agency wherever possible, invest in broad market index funds, keep costs ruthlessly low, and refuse to believe that anyone, whether broker, advisor, or fund manager, could consistently beat the market. He had the data on his side, the integrity to say it plainly, and the courage to sustain a “nonstop blizzard of complaint and criticism” from an industry that hated what he wrote.

MFO pursued a different path. I’ve argued for considering small, boutique managers whose strategies made sense and whose understanding of themselves as “risk managers” rather than “return managers” was deeply ingrained. I believe that thoughtful human judgment, properly applied and fairly compensated, can add value for investors willing to do their homework, most especially in turbulent markets.

Jonathan would have seen this as precisely the kind of thinking he spent his career arguing against. And he wouldn’t have been entirely wrong to be skeptical.

But here’s what mattered more than our tactical disagreement: we shared an absolute commitment to helping people achieve financial security in the face of forces designed to enrich an industry at the expense of those it claimed to serve. Clements and I arrived at different answers, but we were working on the same problem, and we were both trying to solve it honestly.

That honesty was Clements’s defining characteristic. Jason Zweig noted that in over 1,000 columns, Jonathan “never once, to the best of my knowledge, wrote anything that was flagrantly wrong. He never misled or fibbed, or lied to his readers.” In an industry built on obfuscation, that record is astonishing.

But what strikes me most, reading the tributes from those who knew him, is how Clements understood that money was never the point. Money was a tool for building relationships, for creating experiences with family and friends, for making a difference, and for achieving peace of mind. He wrote about raising financially responsible children. He mocked the industry’s obsession with accumulating possessions rather than celebrating meaningful experiences (which is not the same as “selfies”). And in his final year, he wrote with grace and humor about his own dying, making space for others to talk about what we’re all moving toward and helping them feel less alone.

“To philosophize is to learn to die,” wrote Montaigne (with thanks to Jason Zweig for the reminder of Montaigne’s words). Jonathan Clements spent his career teaching people how to live, how to use money as a means rather than an end, how to see through the fog, how to protect themselves and their families from predation dressed up as advice. And then, at the end, he taught us how to face death with laughter and courage and generosity.

The financial services industry will not mourn him. But millions of investors who achieved comfortable retirements because of his clear, consistent, principled guidance will remember him with gratitude. Those of us who disagreed with some of his investment philosophy can still honor the integrity with which he held and expressed it.

In a field that rewards complexity, obfuscation, and self-interest, Jonathan Clements chose clarity, honesty, and service. The example matters more than the investment strategy.

Rest in peace, Mr. Clements. You fought the good fight.

Congratulations to the good folks at Akre Focus

After a small struggle to get their shareholders to endorse or reject a proposal to make AKREX the largest-ever fund-to-ETF conversion. A majority of shareholders finally voted in September to endorse the change. The upcoming benchmarks:

October 10, 2025, the retail ARKEX shares merge with the institutional AKRIX ones

October 24, AKRIX-the-fund becomes AKRE-the-ETF

October 27, ARKE begins trading on the NYSE

While Akre shareholders were considering, BlackRock moved to swiftly convert two funds into active ETFs: the BlackRock GA Dynamic Equity Fund and the BlackRock GA Disciplined Volatility Equity Fund. The new ETF names are iShares Dynamic Equity Active ETF (BDYN) and iShares Disciplined Volatility Equity Active ETF (BDVL). Both are managed by a Global Allocation team headed by the firm’s CIO, Rick Rieder. Both are three-star funds. Since both are part of BlackRock’s “managed portfolio” business, I suspect that the conversion was made to simplify their use for that program.

Thanks, as ever …

Before signing off and getting back to the work you rely on, we want to take a moment to pause and express our deepest gratitude to the readers who truly keep this project alive: our incredible donors. The messages and the money you send are a profound source of encouragement, and they ensure we can keep the lights on (the server lights in this case).

To our bedrock supporters, Greg, William, S & F Advisors, William, Stephen, Wilson, Brian, David, Doug, Altaf: Thank you. We are genuinely humbled by your ongoing commitment. And, to Fred, John, and David who sent donations this month: Thank you for the wonderful lift. Your gifts are an immediate vote of confidence and a powerful reminder that this community is full of people who value the work we do.

I’m utterly diffident about encouraging folks to contribute to the Observer when there are so many pressing needs to address: serious, adult journalism is struggling to find readers willing to pay for reliable information, food banks are being drained at an alarming rate, conservation groups are desperately trying to compensate for the insanity that’s gripped the executive branch, and so on.

Here’s our recommendation: Go do good. Don’t talk about doing it. Do it. Do something. That has two benefits: (1) it steadies you—action is the antidote to despair—and (2) it helps a beleaguered world.

Support your local foodbank

Pay for reliable journalism and pay for reliable local journalism

Support climate action near you

Volunteer at your library

Support independent local booksellers (Bookshop, an Amazon alternative, contributes directly to local bookstores with each book sold)

Support a worthy cause, support a worthy candidate.

Support MFO

The key isn’t what you do. The key is that you do. The chrysanthemums don’t wait for perfect conditions. Neither should we.

As ever,